Breaking News: Bank Of England Base Rate Update

- Expat Property Investments Ltd

- Sep 18, 2025

- 5 min read

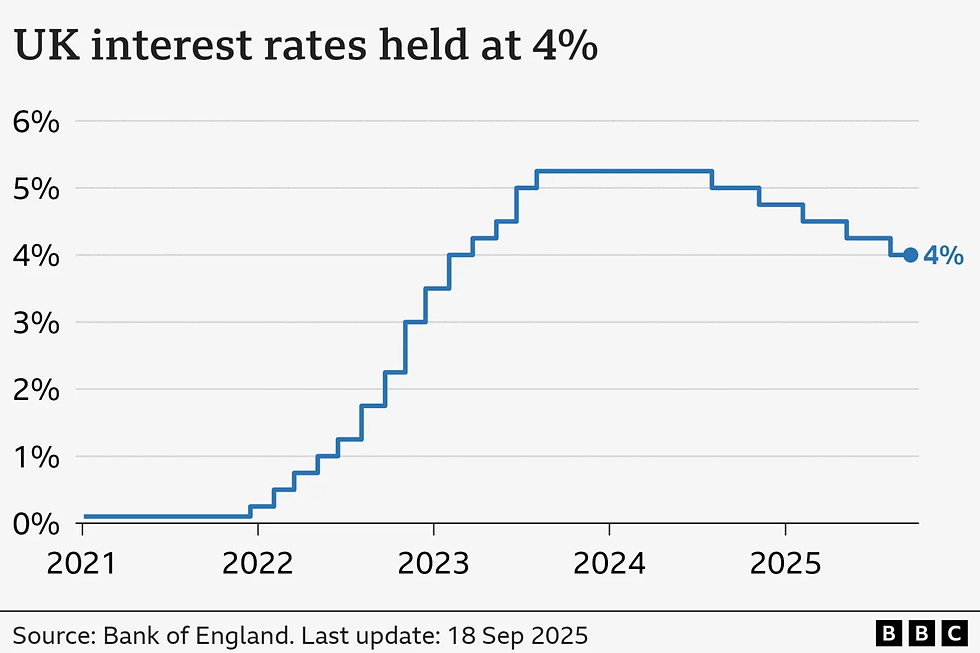

Today, the Bank of England (BoE) decided to hold its base rate at 4%. This brings with it a careful balancing act: inflation remains stubbornly above target, economic growth is weak, and property investors in the UK (especially overseas ones) need to recalibrate expectations and strategies. Below is a detailed, professional analysis of what this means, what to expect, and what actions property investors might take in response.

1. What the Decision Is, and Why It Matters

The BoE’s Monetary Policy Committee (MPC) met and voted 7-2 to keep the base rate at 4%.

Inflation (CPI) is still 3.8% year-on-year as of August 2025, unchanged from July. That is nearly double the BoE’s target of 2%.

Other relevant data points: wage growth is moderating but remains elevated; economic growth is weak or flat; overseas and domestic uncertainties (including fiscal policy around the Autumn Budget) add risk.

The MPC emphasised that while inflation is expected to fall over time, it is too early to gamble on steep cuts. The guiding language from the BoE remains “gradual and careful” easing.

What This Means for UK Property Investors

For property investors, especially those based overseas or relying on mortgage finance, this decision has multiple implications:

1) Mortgage Costs & Financing

Holding the base rate steady means borrowing costs are unlikely to fall in the very short term. If you are refinancing or taking on new debt, expect margins to remain tight.

2) Rental Yields & Cash Flow

With interest rates still high relative to investment returns, cash flow calculations need to be conservative. The cost of servicing debt remains higher than pre-COVID.

3) Property Valuations & Risk of Price Softening

With borrowing being expensive, demand from domestic buyers who rely heavily on financing may soften, putting downward pressure on certain property sectors or locales.

This means that overseas investors who can pay in cash or with low financing costs may find improved bargaining leverage.

4) Currency & Overseas Investors

Currency risk remains relevant. If the pound remains volatile (affected by inflation, fiscal policy, etc.), overseas investors may see gains or losses due to FX movements as much as property performance.

What to Do On The Back Of This Rate Decision

Given the current environment, here are some suggestions (each subject to individual circumstances) for property investors to consider:

Decide if you want to lock in rates now, or take the risk and wait to see if they fall

If you expect rates to stay the same or even tick up, fixed-rate mortgages might offer stability and protect you from future volatility. If you think they will drop soon, it may be worth holding off locking in any new rates in the short term.

Stress Test Cash Flows

Budget for scenarios including high interest, moderate rental growth, downtime, and unexpected maintenance. Ensure margin of safety. This is your safety net.

Focus on Locations & Sectors with Strong Fundamentals

Regions where rental demand outpaces supply (e.g. university towns, city fringes, commuter belts) are likely to perform better. Commercial property may be more exposed, unless in well-located or niche sectors.

Monitor Inflation Components

Those investors whose costs are sensitive to energy, utilities, or materials (e.g. refurbishment, maintenance) need to watch inflation, especially food and services inflation, since they reflect general cost pressures. The BoE has flagged food inflation in particular rising.

Consider Currency Hedging or Structuring

For overseas investors, consider hedging currency risk where appropriate, or structuring ownership/finance to mitigate such exposure.

Stay Alert to Policy & Fiscal Developments

The Autumn Budget (scheduled for 26 November 2025 - mark your calendar) is a key event. Taxation, subsidies, property regulation could change. These could affect cash flows, carrying costs, incentives, and mortgage/tax treatment.

One thing I wanted to mention, which may help with your approach, is my personal opinion and approach. I will be continuing to buy property in the UK, but my mortgages will be on shorter-terms (i.e. 2 years rather than 5 years) so that I can jump onto lower rates quicker should they go down. This is not to say that you should take this approach, you should do your own research and do what is best for your portfolio.

What to Expect Over the Rest of 2025 (with caveats)

While we do not know for certain what will happen next, there are plausible scenarios based on data and the BoE’s current signals. These are educated guesses, not certainties.

Scenario | What Would Trigger It | Likely Timing |

Further cuts (e.g. one or two 25 bps cuts) | Inflation easing more quickly than expected, particularly core inflation/services inflation; stable/slowing wage growth; evidence of economic slack; positive signals in Autumn Budget without inflationary pressures. | Possibly at the November or December MPC meetings. But cuts later in 2025 seem less likely unless data surprises on the downside. |

Rates remain unchanged into 2026 | Inflation stubbornly above 3-4%, wage pressures remain; fiscal policy adding cost pressures; external risks (energy, global commodity prices, exchange rate). | Likely if data does not improve. |

Small increase in rates | Inflation spikes again (food, energy, supply shocks), weak sterling, inflation expectations rising; if inflation overshoots materially; or if fiscal policy is expansionary without offsets. | This is more remote and I don't think will happen, but cannot be ruled out entirely if conditions deteriorate. |

Caveats

All of the above depend heavily on data still to come: inflation figures (core and headline), wage growth, employment/unemployment, GDP growth, and external shocks (e.g. energy, global supply chain issues).

The BoE’s committee is watching not just headline inflation but whether inflation expectations are anchored, whether services inflation is easing, and whether financial conditions remain tight.

Strategic Take-Away

The BoE has chosen caution: holding base rate at 4%, not yet confident that inflation is falling fast enough to permit further cuts.

For property investors, this provides predictability in the near term, but also suggests that any improvements will be incremental.

Financing remains expensive; yields must be assessed carefully.

Strategic focus should be on high-quality assets, good locations, and solid cash flows, along with prudent financing.

Wrap Up

Today’s hold at 4% is not a turning-point towards much lower interest costs overnight for property investors. It reflects (justified) worry that inflation remains too high, and the fragility of the economic environment. Investors who prepare for a range of outcomes, hedge risks, lock rates where beneficial, and focus on resilient property segments are likely to fare best.

If you’d like tailored advice, especially for overseas investors looking into UK property, structuring finance, or modelling cash flows under different interest/inflation scenarios, contact us here.

We offer bespoke investment services, one-off consulting calls, and scenario analysis to help our clients navigate uncertain environments and make informed UK property investment decisions.

Comments